November and December bring urgent financial planning for millions of Americans with flexible spending accounts. That pre-tax money you've been setting aside all year? It disappears on December 31 if you don't use it. The use-it-or-lose-it rule forces strategic decisions about health investments that genuinely improve your family's wellbeing rather than panic purchases of unnecessary items just to avoid forfeiting funds.

Understanding Your FSA Deadline

Flexible spending accounts let you save pre-tax money for qualified medical expenses. The 2025 maximum contribution is $3,300. That's substantial tax savings—money you've already earned that won't be taxed if used appropriately. But contributions generally expire at year-end unless your employer offers extensions.

Some companies provide a grace period of up to 2.5 extra months to spend your balance. Others allow carrying over up to $660 into the next year. Check your specific plan rules immediately. Don't assume you have flexibility you may not actually have.

If you need to spend FSA funds before December 31, focus on health investments that provide lasting value rather than grabbing random qualifying items in year-end panic.

Medical Equipment and Devices

Many medical devices qualify for FSA spending and offer long-term health benefits. Blood pressure monitors help track cardiovascular health. Pulse oximeters measure blood oxygen levels—particularly valuable for people with respiratory conditions. Digital thermometers, glucose monitors for diabetics, and nebulizers for asthma management all typically qualify.

Check your FSA administrator's approved items list before purchasing. Rules vary between plans, and what qualifies under one FSA may not qualify under another. When in doubt, contact your administrator directly or ask for pre-approval on larger purchases.

Some medical equipment requires a letter of medical necessity from your healthcare provider. If you're considering significant health investments, consult your doctor first. Their documentation strengthens your case for FSA reimbursement and ensures you're purchasing equipment that actually addresses your medical needs.

Schedule Preventive Care and Treatments

Medical appointments and procedures represent some of the best uses of FSA funds. Schedule dental cleanings, eye exams, and routine preventive care before year-end. These services cost the same whether paid with FSA funds or regular income—but FSA purchases save you tax money.

If you've been postponing needed medical care, now is the time to act. That root canal you've been avoiding? Use FSA funds. Vision correction procedures? Schedule before December 31. Physical therapy sessions for chronic pain? Book appointments now.

Prescription medications you'll need in coming months can be purchased with year-end FSA funds. Talk to your doctor about getting prescriptions filled now for medications you take regularly. A three-month supply purchased in December uses funds that would otherwise expire while ensuring you have medications you need anyway.

Over-the-Counter Health Products

Over-the-counter medications now qualify for FSA spending without prescriptions. Pain relievers, allergy medications, cold medicine, and first aid supplies all count. Build a well-stocked medicine cabinet using pre-tax dollars instead of losing those funds entirely.

Feminine hygiene products, sunscreen, and other personal care items with health purposes qualify for FSA spending. These everyday necessities represent smart use of funds that would otherwise disappear. Contact lens solution, reading glasses, and other vision care supplies typically qualify as well.

Bandages, antibacterial ointments, heating pads, and ice packs all fall under qualifying medical supplies. Stock up on items your family uses regularly. You're not gaming the system—you're strategically purchasing health products you need using the tax-advantaged funds designed for exactly this purpose.

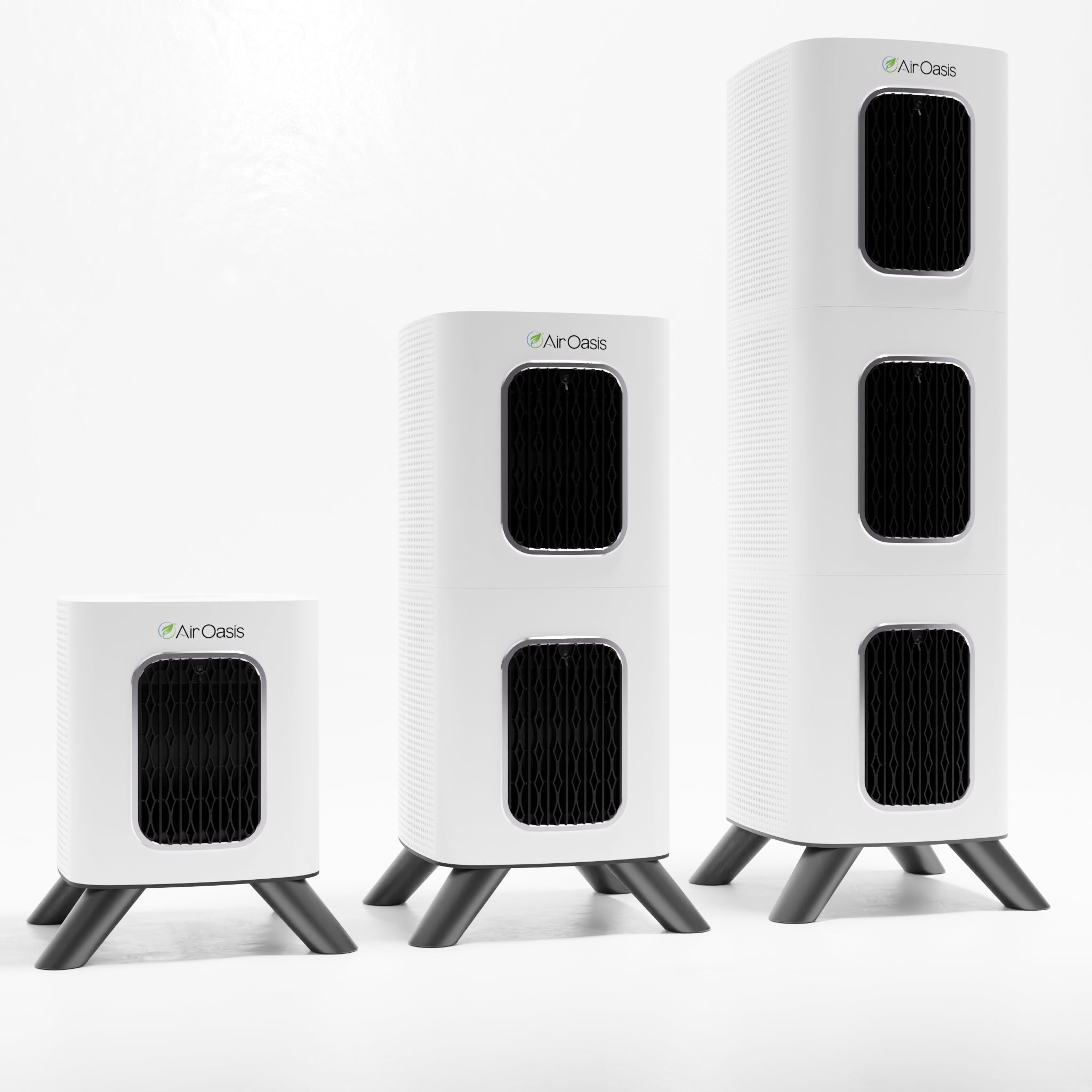

Improving Indoor Air Quality

Indoor air quality significantly impacts respiratory health, particularly for people with allergies, asthma, COPD, and other breathing conditions. While FSA eligibility for air purifiers varies by plan and may require medical documentation, improving your home's air quality remains a worthwhile health investment.

Consult your healthcare provider about air quality solutions for your specific respiratory conditions. They can recommend appropriate interventions and may provide documentation supporting medical necessity. Some FSA plans cover air purification equipment when prescribed for specific medical conditions, while others don't. Check with your FSA administrator about your plan's specific rules.

Even if air purifiers don't qualify for your particular FSA, addressing indoor air quality protects respiratory health year-round. Medical-grade purification removes allergens, irritants, and pathogens that trigger symptoms and exacerbate chronic conditions. Consider this health investment using other funds if FSA coverage isn't available.

HSA Funds: A Different Timeline

Health savings accounts operate differently from FSAs. HSA contributions for 2025 can continue until April 15, 2026—giving you extra months to maximize tax-advantaged savings. The 2025 HSA contribution limit is $4,300 for individuals and $8,550 for families, with an additional $1,000 catch-up contribution if you're 55 or older.

Unlike FSAs, HSA funds never expire. Money grows tax-free, and withdrawals for qualified medical expenses remain tax-free indefinitely. This makes HSAs powerful long-term health savings vehicles rather than use-it-or-lose-it accounts requiring year-end scrambling.

Consider maxing out HSA contributions even if you don't need the funds immediately. The money can grow invested for decades, creating a health care nest egg for retirement when medical expenses typically increase. Some financial planners call HSAs "the ultimate retirement account" because of their triple tax advantage—tax-deductible contributions, tax-free growth, and tax-free withdrawals for medical expenses.

Pay for current medical expenses out of pocket while letting HSA balances grow if you can afford this strategy. Save receipts for those expenses. You can reimburse yourself from your HSA years later, allowing maximum tax-free growth in the meantime. This approach treats your HSA as a retirement health account rather than a spending account.

Documentation Protects You

Keep receipts and documentation for all FSA and HSA purchases. While many items clearly qualify, you may need to provide proof if questioned. Store receipts digitally using apps or cloud storage to prevent loss.

Most FSA administrators provide lists of automatically qualifying items. Review these lists before making purchases to avoid buying something that won't be reimbursed. Some plans offer debit cards for immediate FSA spending at qualifying vendors. Others require you to submit receipts for reimbursement.

For larger or questionable purchases, request pre-approval from your FSA administrator. A few minutes confirming eligibility prevents frustration and financial loss if reimbursement is denied. Don't assume something qualifies just because it seems health-related.

Make Strategic Year-End Decisions

Don't buy health items you don't need just to spend FSA funds. But don't forfeit money either when legitimate health investments would benefit your family. Focus on medical care you've been postponing, medications you'll need anyway, and medical supplies your household uses regularly.

Think beyond December when planning FSA spending. If your plan offers a grace period or carryover, you have additional time for strategic purchases. Use December for immediate needs and save the remaining balance for early-year medical expenses if your plan allows.

Check your FSA balance today. Review your employer's specific rules about grace periods and carryovers. Then make informed decisions about health investments that provide lasting value using the pre-tax savings you've earned.

Respiratory health affects every aspect of daily life. Sleep quality, energy levels, cognitive function, and overall well-being improve when you breathe cleaner air. Whether purchased with FSA funds or regular income, medical-grade air purification delivers daily health benefits, protecting your family's respiratory wellness.

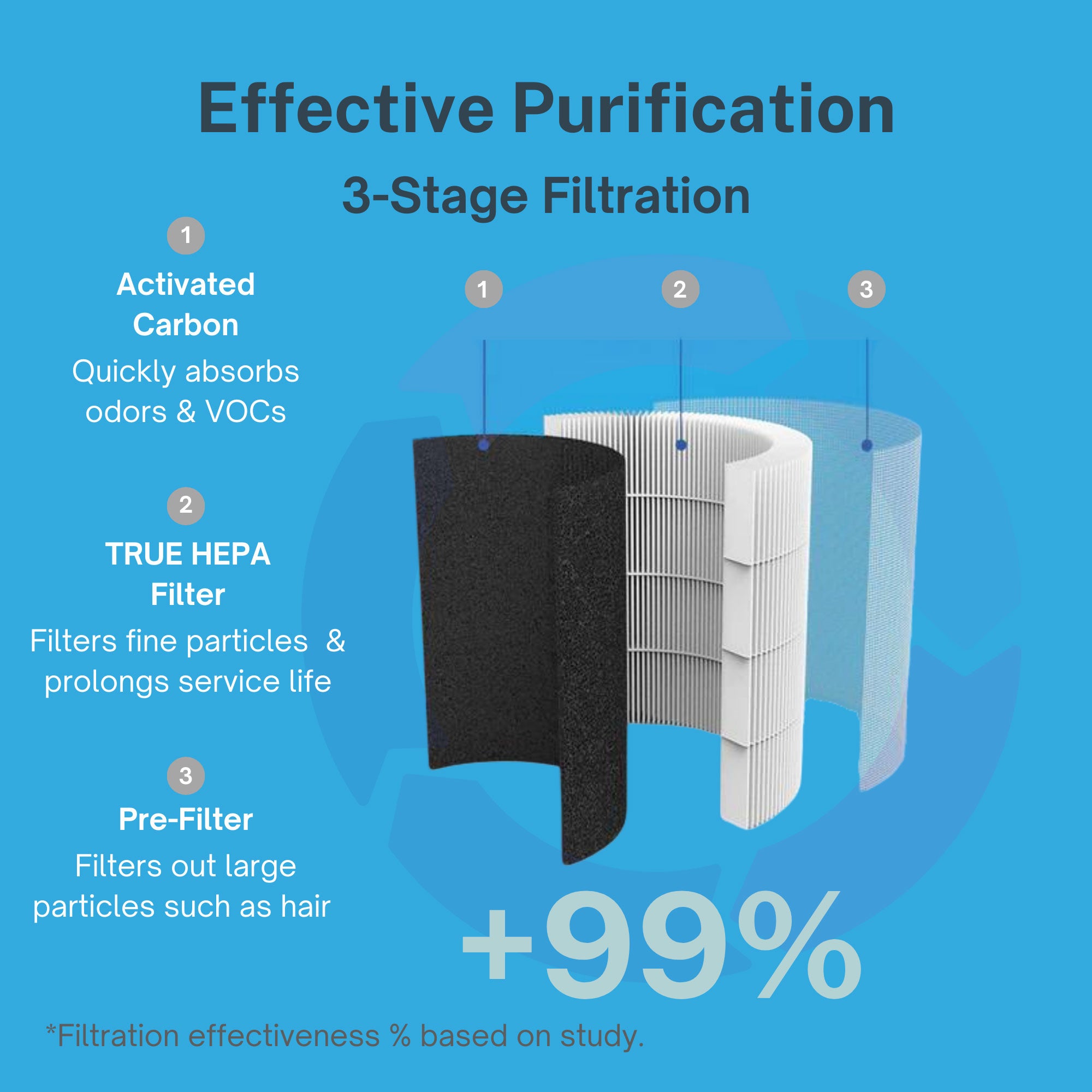

The iAdaptAir system provides comprehensive air purification through HEPA filtration, activated carbon, UV-C light, and bipolar ionization. This multi-stage approach removes allergens, VOCs, bacteria, and viruses that compromise indoor air quality. Consult your healthcare provider and FSA administrator about coverage possibilities, or consider this health investment as part of your broader wellness planning.

Stop letting pre-tax health savings go to waste. Invest strategically in medical care, equipment, and supplies that protect your family's health. Shop Air Oasis today for air purification that supports respiratory wellness year-round.